Financing

Financing

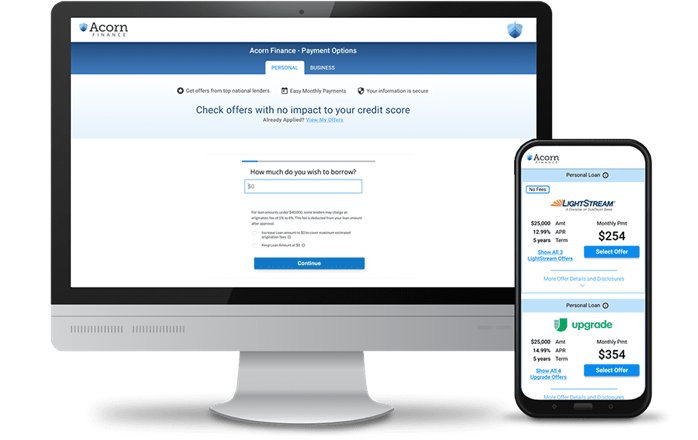

Acorn Finance

We are teaming up with Acorn Finance to offer our clients simple financing options to help make their home improvement project become a reality. With Acorn Finance, you can buy now and pay monthly. It’s quick, simple, and secure!

Not only that, but you can apply now and it won’t affect your credit score. Additionally, you can get all the help you need for financing your home improvement. Get started with Acorn Finance today!

Acorn Finance Benefits

1 – Pre-Qualify

Get started by filling out an easy form online to check for pre-qualified offers. This does not impact your credit score.

2 – Select offer

Next, browse and compare terms and payment options. Select the offer that works best for you.

3 – Finish application

Next, you will need to finish the application process on your lender’s website.

4 – Receive funding

Once your loan is approved, you can expect to receive your funds within one to two business days.

Accredited Financing

Acorn Financing is accredited, safe, and secure. Get started today and enjoy financing that’s 100% online, 100% easy, and 100% safe.

Have questions? Please give our team a call today to get started with your home improvement project!

How does Acorn Finance Compare

HVAC Financing For Good or Bad Credit

Acorn Finance puts you in control of finding the best HVAC financing options – they let you compare personalized offers from lenders in their network, with no impact to your credit score.

They will help you check for pre-qualified offers to secure HVAC financing in seconds with their broad network of national lending partners.

You can easily sort the offers based on what’s most important to you: interest rate, payment amount, length of the loan term.

Their 100% online, customer-friendly process is designed to help you find affordable payment options with lenders that can quickly fund your project.

Ready To Check Offers for HVAC Financing?

Compare HVAC & AC loans without affecting your credit score.

FAQ

What is Acorn Finance?

Acorn Finance is a leading lending marketplace to pre-qualify customers for personalized loans, with no impact to the customer’s credit score. Acorn Finance utilizes a soft credit inquiry to provide homeowners with access to fixed-rate, competitive loans through a quick and easy online application process.

Can you finance a HVAC system?

Yes, you can finance a HVAC system. Financing can allow you to purchase and install the HVAC system you need, without depleting your savings account. In most cases, you can finance a HVAC system with no money down. A popular choice for HVAC financing is a personal loan. Personal loans can be secured from banks, online lenders, or credit unions. If you are working with a large HVAC company, they might also offer some form of financing directly from the company. It’s always worth asking and checking to see that way you know which options are available to you.

What credit score do you need to finance a HVAC system?

Credit score requirements can vary depending on the lender. Some lenders are more lenient with financing than others. Most lenders will require a score of 600 or higher though. If your score is less than 600, you will probably have a hard time securing financing because you are considered to be a risky lender. Lenders may also take into account other factors such as income, job stability, and so forth. If you are unfamiliar with your credit score, you should check it before applying for a loan.

If you can’t find a lender to work with you, you might want to consider trying to raise your credit score or lowering your debt-to-income ratio to try and get a loan.

Should I finance my HVAC?

If you have a good credit score and can get a low-interest loan, financing your HVAC is not a bad idea. In most cases, you don’t want to use your entire savings for an HVAC system, so financing all or some of it can help you get a new system and be able to keep some money in savings.

If your credit is low though and you can’t get a low-interest loan, financing might not be the best idea. You don’t want to end up overspending on interest and having a loan that’s overwhelming to you and your monthly budget.

How long can you finance an AC unit?

Terms can vary depending on the lender. They may also vary depending on what you qualify for. For example, a borrower with a low credit score may qualify for a shorter loan term than a borrower with a high credit score. The amount you borrow can also impact the terms. You can find personal loans with terms between one to twelve years, depending on credit score. Make sure you are choosing a loan repayment term that works for your budget. Keep in mind longer repayment terms may have lower monthly payments but higher total loan costs.

How do you pay for HVAC?

Some people choose to pay for their HVAC with cash if they have it available. This isn’t a choice for everyone though as not everyone has enough cash laying around. Credit cards are another popular way that people pay for HVAC because it allows them to borrow the money for a short period of time before they have to pay it back. Credit cards can have high interest though and aren’t the best choice for everyone. Personal loans usually offer lower interest and better repayment terms.

How can I finance an air conditioner with bad credit?

Financing an air conditioner with bad credit is possible. If you have the ability to boost or improve your credit score some before taking a loan you definitely should. While you may qualify for financing with bad credit, the rates can be high, the terms can be short, and the loan amounts may be low. On the brightside, if you are able to qualify for financing and repay the loan on time it can help your credit score. One of the biggest downsides of borrowing money with bad credit is the cost.

Does HVAC zero percent financing exist?

You may be able to find zero percent financing options for HVAC systems. In most cases, you can find promotional financing offers such as zero percent financing through retailers or manufacturers. To qualify you will likely need very good credit. They may only offer the promotional financing for a short term so you will want to make sure you can afford the monthly payment and pay the loan off during the promotional period. After the promotional period ends there can be extremely high interest rates applied. If you are considering HVAC financing, explore all available options to make an educated financial decision.

Is it cheaper to replace the furnace and AC together?

In most cases it’s cheaper to replace the furnace and AC together. Replacing a furnace alone usually costs about $2,000 to $5,000. When you add a furnace during an air conditioner replacement, it should cost less. However, if your furnace is less than 10 years old, it may make sense to replace it solo. There’s a good chance it should last until your AC needs to be replaced. A furnace should last 20-30 years and AC systems should be replaced every 10-15 years. If your furnace is 15+ years old you should replace the furnace and AC together. In addition, if installation is complicated or you want to avoid HVAC repairs or replacements for a long time you should replace the furnace and AC together.

ADDRESS

4348 Durham Road, Kintnersville, PA. 18930

PHONE NUMBER

267-733-8848

E-MAIL ADDRESS

pureairemechanical@gmail.com

Contractors #

PA176560

Please fill out this form with a brief description of possible issues, problems or service you may need and we will get back to you with a quick response.

contact

Copyright © 2022 PureAire Mechanical LLC - All rights reserved